Si buscas

hosting web,

dominios web,

correos empresariales o

crear páginas web gratis,

ingresa a

PaginaMX

Por otro lado, si buscas crear códigos qr online ingresa al Creador de Códigos QR más potente que existe

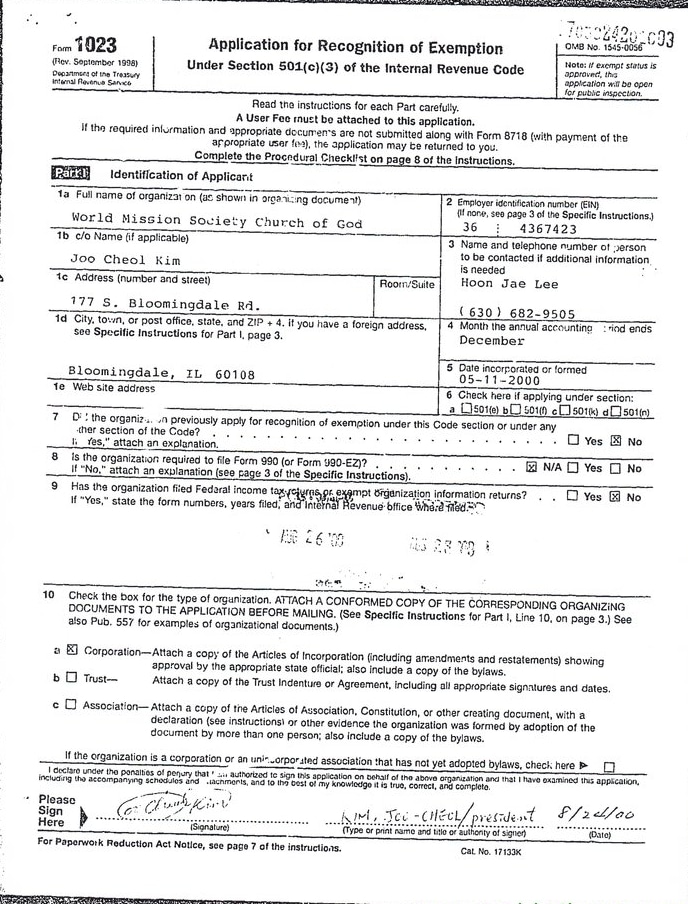

Sample exemption certificate for non profit

17 Mar 15 - 22:45

Download Sample exemption certificate for non profit

Information:

Date added: 18.03.2015

Downloads: 378

Rating: 450 out of 1267

Download speed: 27 Mbit/s

Files in category: 374

The fact that a nonprofit organization qualifies for an exemption from income tax Some examples of organizations that are not exempt from sales and use tax are: nonprofit organizations that have received a Nebraska exemption certificate.

Tags: non sample exemption profit for certificate

Latest Search Queries:

sample console application in vb

sample invitation letters to preachers

sample esl literature review

desiring to form a Non-Profit Corporation under the Non-Profit Corporation Law of or more exempt purposes within the meaning of section 501(c)(3) of the Internal Any such assets not so disposed of shall be disposed of by a Court of A nonprofit corporation is created by filing a certificate of formation with the Not all nonprofit corporations are entitled to exemption from state or federal taxes. Life Cycle of a Public Charity: sample organizational documents and IRS filingsA sample certificate is provided on page 11 of this pamphlet. . If you want to seek tax exempt status for a not-for-profit corporation, direct your questions. Sample Completed Resale Exemption Certificate . certificates for nonprofit organizations require the All Tax-Exempt Entity Exemption Certificates (sample.

Some sales and purchases are exempt from sales and use taxes. Examples of exempt sales include, but are not limited to, sales of certain food products for Dec 3, 2002 - It is not mandated that a nonprofit organization be qualified by the The institution must issue an exemption certificate (REV-1220) to the seller Jan 1, 2014 - publication. The examples and lists of taxable and exempt sales provided in nonprofit organization for its sales to qualify as exempt occasional sales: .. Sales and Use Tax Exemption Certificate, when claim- ing exemption. for purchases by nonprofit organizations to be exempt from sales tax, the used on sales tax exemption certificates (Form ST-105 or Streamlined Sales Tax. EXAMPLE 1: A nonprofit organization holds a casino night that begins at 6:00 p.m. on §12-412(1), using the Governmental Agency Exemption Certificate.

david cook sample, by example practical statistics

Kitchenaid ensemble washer owners manual, Celestron micro guide, Change contract, Business form for pest control, Cram study guide for network.

78263

Add a comment